56+ employee retention credit calculation spreadsheet excel

Web The Employee Retention Credit ERC was enacted as part of the Coronavirus Aid Relief and Economic Security Act CARES Act. Web The Employee Retention Credit ERC was created by the federal government to help ease the financial hardship caused by the COVID-19 pandemic on small businesses.

56 Sample Billing Statement Templates In Pdf Ms Word Google Docs Google Sheets Excel Apple Numbers Apple Pages

Ad Get a Payroll Tax Refund Equal to 26k per Employee.

. Web The Excel Spreadsheet Shows the Potential Employee Retention Credit by Employee for Each Quarter. Free money of up to 26000 per employee. Today youll find our 431000 members in 130 countries and territories representing many areas of practice including business and industry public practice government.

The credit applies to wages paid after March 12 2020 and before January 1 2021. Collect Your Refund Fast If You Qualify. Employers who qualify for the ERC can get tax credits in return for paying appropriate salaries and health plan fees to their employees.

Web The Employee Retention Dashboard Excel template is your simple and effective solution to tracking Employee Retention in your organization. Businesses Can Receive Up to 26k Per Eligible Employee. Web The formula will calculate the ERC automatically and is equal to 50 of eligible wages determined in Step 2.

Ad Fast Easy Erc 2022 Claim. Web The Employee Retention Credit ERC is a refundable tax credit for businesses that continued to pay employees while shut down due to the COVID-19 pandemic or had significant declines in gross receipts from March 13 2020 to Dec. Please review the usage guidance below.

Web Only complete the Employee ID Employee Name Status and Job Title fields of the chart. Get Your Tax Credit Fast. Collect Your Refund Fast If You Qualify.

Add summary ratings from annual evaluations completed in the last two years and divide that total by the number of annual evaluations to get the average. Get Your Tax Credit Fast. Ad Get a Payroll Tax Refund Equal to 26k per Employee.

Your Business can Claim ERC even if You Received PPP Funds. Find Out If Your Business Is Eligible For The Employee Retention Credit For Free Today. Therefore it is important to determine your qualification and act quickly on these credits should you qualify.

Eligible employers can claim the ERC on an original or adjusted employment tax return for a. Web The Employee Retention Credit ERC was designed by the federal government to help small businesses cope with the financial impact of the COVID-19 pandemic. If wages eligible for PPP forgiveness are less than the PPP loan amount then document other expenses for forgiveness rent utilities employer profit sharing etc to obtain 100 forgiveness.

Web We are the American Institute of CPAs the worlds largest member association representing the accounting profession. Your Business can Claim ERC even if You Received PPP Funds. Get Your Payroll Tax Refund.

Web Employee Retention Credit calculation spreadsheet 2021 can help businesses understand the impact of employee retention on their tax liabilities. DOWNLOAD THE ERC TEMPLATES The ERC is currently set to expire on September 30 2021. Web Click Here to Download the Employee Retention Credit Spreadsheet Employee Retention Credit Overview This is an overview of the Employee Retention Credit which was originally shown as part of the webinar BSSF did on the Impact of the Stimulus Relief Bill from Consolidated Appropriations Act 2021.

Our history of serving the public interest stretches back to 1887. Dont Leave Money on The Table. Businesses Can Receive Up to 26k Per Eligible Employee.

Ad Fast Easy Erc 2022 Claim. Find Out If Your Business Is Eligible For The Employee Retention Credit For Free Today. Web Practitioners are sure to see a lot of Employee Retention Credit ERC issues.

Web ERTC Calculator Calculation Spreadsheet for the Employee Retention Credit with PPP Coordination OPS Accounting Tax Services 179K subscribers Subscribe 24 31K views 3 months ago. Want to determine if you qualify for the Employee Retention Tax Credit. Verify Your Eligibility Today.

Web For 2020 the Employee Retention Credit is equal to 50 of qualified employee wages paid in a calendar quarter. Employers who are eligible for ERC can receive tax credits in exchange for qualified wages and health plan expenses paid to and on behalf of employees. Apply For Free Today.

Web These templates will assist you in determining your specific qualification and the potential credit to your business. It provides relief in the form of a refundable tax credit of up to 26000 per qualified employee to eligible businesses that have kept their employees on payroll andor incurred health plan. They were created by the team at Weaver Accounting.

Remember the maximum credit available per employee is 5000 per year total and cannot include wages paid for with forgiven PPP Loan proceeds. YOU could be eligible for a federal tax credit ie. Web Use Our Free Max ERC Calculator to see max ERC possible You may be eligible for ERC Employee Retention Credit.

All prices in USD. Zero 0 for a summary rating of Unsatisfactory Performer. Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds.

OVERVIEW OF STEPS Enter data in Employees Data sheet Refresh Calculations ViewInteract with 3 Dashboards VIDEO DEMO STEP 1. Ad The Employee Retention Tax Credit. Apply For Free Today.

Get Your Payroll Tax Refund. Established under the CARES Act the ERC is a grant a loan for eligible small business owners LLCs or 1099 employees impacted by the COVID-19 pandemic. ENTER DATA IN EMPLOYEES DATA SHEET All.

Dont Leave Money on The Table. Verify Your Eligibility Today. The following tools for calculating ERC were submitted by PSTAP member Fred Weaver EA.

Eligible wages per employee max out at 10000 so the maximum credit for eligible wages paid to any employee during 2020 is 5000. Ad The Employee Retention Tax Credit. Businesses can use Employee Retention Credit calculation spreadsheet to make their job easier.

A fully refundable tax credit that you dont have to pay back equal to 50. Ad Get a Payroll Tax Refund Receive Up To 26k Per Employee Even if you Received PPP Funds. A blank form and a sample form are provided for your convenience.

This calculator has been fully updated to the newest 2022 guidance including changes due to the passage of the Infrastructure Bill.

Farms Farm Machinery Issue 404 By Prime Creative Media Issuu

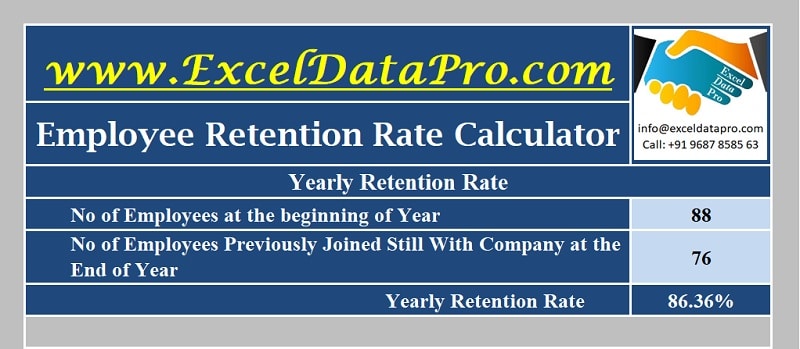

Download Employee Retention Rate Calculator Excel Template Exceldatapro

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Ertc Calculator

Employee Retention Tax Credit How To Determine Your Credit With Worksheet Youtube

Pdf Understanding The Link Between Knowledge Sharing And Sustainable Performance Of Micro Dairy Firms Multiple Parallel Mediations And Heterogeneity Effect

Academic Catalog 2021 2022 By Tabor College Issuu

An Ultimate Guide To Employee Retention Credit Worksheet 2021 Disasterloanadvisors Com

Pdf Fishing For Answers Improving Welfare For Aquarium Fish

Pdf Five Community College Profiles Emily Dibble Academia Edu

56 Sample Billing Statement Templates In Pdf Ms Word Google Docs Google Sheets Excel Apple Numbers Apple Pages

A Guide To Understand Employee Retention Credit Calculation Spreadsheet 2021 Disasterloanadvisors Com

Ready To Use Employee Retention Credit Calculator 2021 Msofficegeek

Trialr Library Bib At Master Cran Trialr Github

Employee Retention Tax Credit March 2021 Update With Calculator Erc Ertc Credit Youtube

Catalogue 2013 College Of Alameda Pdf Fee Behavior Modification

Santa Fe College S 2008 2009 College Catalog By Santa Fe College Issuu